Balance sheet growth represents one of the most fundamental indicators of a company’s financial health and expansion trajectory. Understanding this concept is crucial for business owners, investors, and financial professionals who want to make informed decisions. At Tradeizze, we recognize that mastering financial analysis skills can significantly impact your business success and investment outcomes.

When companies expand their operations, acquire new assets, or increase their market presence, these changes reflect directly on their balance sheets. However, not all growth is created equal. Some growth patterns indicate healthy business expansion, while others might signal potential financial troubles ahead.

Effective balance sheet growth analysis requires understanding both the quantitative metrics and the qualitative factors that drive these changes. This comprehensive approach helps stakeholders identify sustainable growth patterns and avoid common pitfalls that can undermine long-term financial stability.

Table of Contents

ToggleWhat Is Balance Sheet Growth

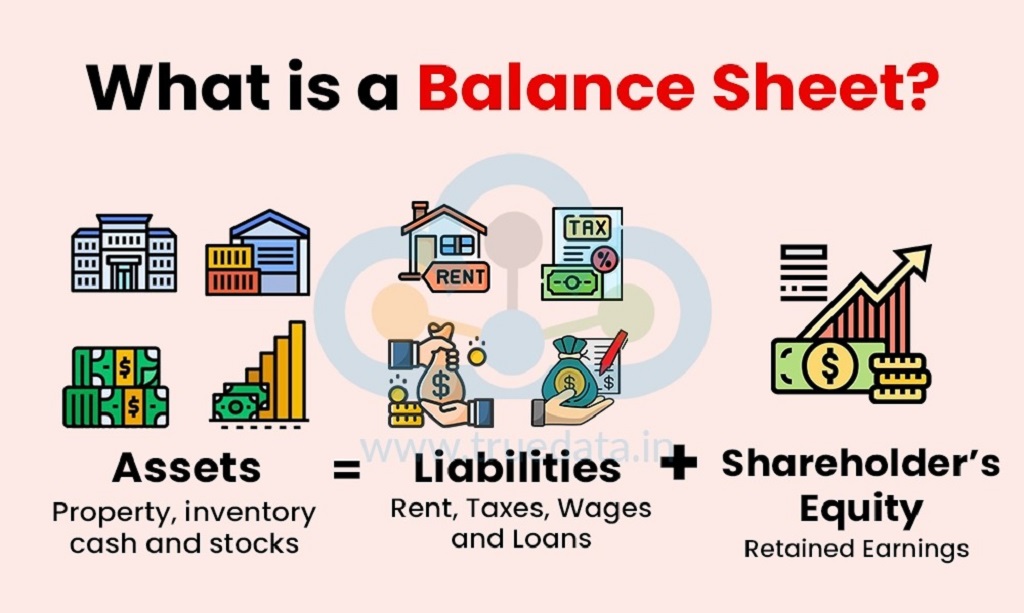

Balance sheet growth refers to the increase in a company’s total assets, liabilities, or equity over a specific period. This growth can manifest in various ways, including asset expansion, revenue reinvestment, or strategic acquisitions.

The concept encompasses both positive and negative changes in balance sheet components. While asset growth often indicates business expansion, it must be evaluated alongside liability and equity changes to provide a complete picture of financial health.

Companies typically experience balance sheet growth during periods of business expansion, market penetration, or operational scaling. However, understanding the underlying drivers of this growth is essential for proper evaluation.

Key Components of Balance Sheet Growth

Asset Growth

Asset growth represents the expansion of resources under company control. This includes current assets like cash, inventory, and accounts receivable, as well as fixed assets such as property, equipment, and investments.

Current asset growth often indicates increased business activity and operational expansion. However, excessive inventory growth might signal demand forecasting issues or market challenges.

Fixed asset growth typically reflects long-term strategic investments in business infrastructure. These investments can enhance future earning capacity but require careful evaluation of return on investment.

Liability Growth

Liability growth shows how companies finance their expansion. This includes both current liabilities like accounts payable and short-term debt, as well as long-term obligations such as mortgages and bonds.

Strategic liability growth can indicate healthy leveraging of debt to finance profitable opportunities. However, excessive debt accumulation might create financial stress and limit future flexibility.

The relationship between asset and liability growth provides insights into funding strategies and financial leverage decisions.

Equity Growth

Equity growth reflects increases in shareholder ownership value through retained earnings, additional investments, or stock appreciation. This growth indicates value creation for business owners and investors.

Retained earnings growth demonstrates the company’s ability to generate profits and reinvest them for future expansion. This internal funding source reduces dependence on external financing.

Additional equity investments show confidence from existing or new investors in the company’s growth prospects and management capabilities.

How to Measure Balance Sheet Growth

Percentage Growth Analysis

Calculate percentage changes by comparing current period values to previous periods. This method standardizes growth measurements across different balance sheet components and time frames.

For example, if total assets increased from $500,000 to $600,000, the growth rate equals 20%. This calculation applies to any balance sheet line item.

Additionally, annualized growth rates help compare performance across different time periods and provide benchmarks for future projections.

Ratio Analysis

Financial ratios provide deeper insights into growth quality and sustainability. Key ratios include debt-to-equity, asset turnover, and return on assets.

The debt-to-equity ratio measures financial leverage and indicates how much debt finances asset growth. A rising ratio might signal increased financial risk.

Asset turnover ratios show how efficiently companies utilize their growing asset base to generate revenue. Declining ratios might indicate inefficient asset utilization.

Trend Analysis

Examine growth patterns over multiple periods to identify trends and cyclical patterns. This analysis helps distinguish between temporary fluctuations and sustained growth trajectories.

Quarterly and annual comparisons reveal seasonal patterns and long-term trends. Therefore, consistent growth over several periods indicates more sustainable business expansion.

Furthermore, trend analysis helps predict future growth patterns and identify potential inflection points in business performance.

Interpreting Growth Patterns

Healthy Growth Indicators

Healthy balance sheet growth typically shows proportional increases across assets, manageable liability growth, and strong equity accumulation. These patterns suggest sustainable business expansion.

Revenue growth should accompany asset growth, indicating effective utilization of expanded resources. Moreover, profit margin maintenance or improvement during growth periods demonstrates operational efficiency.

Cash flow generation remains positive during healthy growth phases, ensuring adequate liquidity for operations and debt service obligations.

Warning Signs

Rapid asset growth without corresponding revenue increases might indicate inefficient resource allocation or market challenges. This disconnect requires careful investigation.

Excessive debt accumulation relative to equity growth creates financial leverage risks and potential liquidity constraints during economic downturns.

Declining profitability during growth periods suggests operational inefficiencies or competitive pressures that need addressing.

Strategies for Sustainable Balance Sheet Growth

Asset Management

Focus on acquiring assets that generate strong returns and support core business objectives. Avoid speculative investments that don’t align with strategic goals.

Implement regular asset reviews to identify underperforming resources and optimize asset allocation. This approach ensures maximum value creation from invested capital.

Develop clear criteria for asset acquisition decisions, including return on investment thresholds and strategic fit assessments.

Capital Structure Optimization

Maintain balanced financing sources between debt and equity to optimize capital costs while managing financial risks.

Consider debt maturity profiles and interest rate environments when planning growth financing strategies. This planning helps minimize refinancing risks and interest expenses.

Evaluate alternative financing options such as equipment leasing, factoring, or revenue-based financing for specific growth initiatives.

Performance Monitoring

Establish regular monitoring systems to track growth metrics and identify potential issues before they become problems.

Create dashboard reports that highlight key performance indicators and growth trends for management review and decision-making.

Set up automated alerts for ratio changes that might indicate emerging financial stress or operational challenges.

Common Mistakes to Avoid

Many companies focus solely on top-line growth without considering profitability and cash flow implications. This approach can lead to unsustainable expansion and financial difficulties.

Overleveraging during growth phases creates vulnerability to market downturns and limits strategic flexibility. Maintaining conservative debt levels provides better long-term stability.

Ignoring working capital requirements during expansion can create cash flow problems despite profitable operations. Plan for increased inventory, receivables, and other working capital needs.

Read More Also: Educational AI Kits for Children of the Future

Conclusion

Balance sheet growth serves as a critical indicator of business health and expansion success. However, effective measurement requires analyzing multiple components and understanding the relationships between assets, liabilities, and equity changes.

Successful companies focus on sustainable growth patterns that enhance long-term value creation rather than pursuing growth at any cost. This approach involves careful asset management, optimal capital structure decisions, and continuous performance monitoring.

By implementing proper measurement techniques and avoiding common pitfalls, businesses can achieve healthy balance sheet growth that supports long-term success and stakeholder value creation.

Read More Also: How to Skate Backwards on Roller Skates

Frequently Asked Questions

What is considered good balance sheet growth?

Good balance sheet growth typically ranges from 5-15% annually, depending on industry and company size. The growth should be accompanied by proportional revenue increases and maintained profitability margins.

How often should I analyze balance sheet growth?

Most businesses should review balance sheet growth quarterly, with more frequent monitoring during rapid expansion phases. Monthly reviews may be necessary for companies in volatile industries or experiencing significant changes.

Can balance sheet growth be too fast?

Yes, excessive growth can strain resources, create cash flow problems, and lead to operational inefficiencies. Sustainable growth rates vary by industry but should align with management capabilities and market conditions.

What causes negative balance sheet growth?

Negative growth can result from asset sales, debt repayment, dividend distributions, or business contractions. While sometimes concerning, it may also indicate strategic restructuring or return of capital to shareholders.

How does balance sheet growth differ from revenue growth?

Revenue growth measures income statement performance, while balance sheet growth examines changes in financial position. Both metrics are important, but balance sheet growth provides insights into resource allocation and financial structure changes.